Most of the developed nations (almost 80%) in the world has adopted to GST system of tax. France was first country to implement GST way back in 1954. Important to mention here that, United States of America and China do not have GST implemented. This page discusses basics of GST in Indian context.

Types of GST || Rates of GST || When is GST Levied? || Invoicing under GST || E-Waybill || Non-GST Items Goods and Service [exclusion list from GST] || Download HSN code list

Types of GST

CGST – Central GST

SGST – State GST

IGST – Inter-State GST

UTGST – Union Territory GST

GST has to be charged based on the destination of supply. For raising a correct tax invoice, one has to first determine if the supply is an inter-state or intra-state. CGST-SCST/UTGST is applicable in an intra-state transaction and IGST is applicable in the inter-state transaction. To clarify further, if a seller sales product in his own state i.e. the address of customer is in his state only then CGST-SGST (UTGST in place of SGST if the transaction is in and from a union territory region), in the other case, if a seller sales (actually ships) his product to another state (other than his one state) then IGST has to be charged.

Rates of GST

When GST was introduced in July 1st 2017, 7 rates for goods and 5 rates for services were announced

Goods – (Nil, 0.25 per cent, 3 per cent, 5 per cent, 12 per cent, 18 per cent, 28 per cent)

Service – (Nil, 5 per cent, 12 per cent, 18 per cent, 28 per cent)

When GST to be levied? Which GST is to be Levied?

GST (stands for Goods and Service Tax) is a comprehensive indirect tax to be levied on manufacture, sale, consumption of goods and services.

For goods, GST is levied during supply. Hence, it is mandatory to raise a GST invoice during any supply of goods. The supply necessarily may not mean sale of goods. The incident of supply can also take place by transferring goods to another location within a company / entity. It can also refer transaction take place for leasing, exchange, rental etc.

For Service, GST invoice is to be raised with appropriate SAC Code [explained later in this article]

Invoicing under GST

One needs to issue a Tax Invoice for all taxable goods and services, if it is registered under GST.

If you check the search engine queries, many people look for GST invoice format in word. IF you follow the details given below, one can easily create invoice format. This is to mention here that the GST Act, has not prescribed any specific format for creating GST invoice.

Invoicing under GST is done “as per section 31 of the CGST Act”. An invoice raised for supply of goods is issued before or at the time of removal of goods for a supply to the customer/recipient.

Name and address, and GSTIN of the supplier (in case the business has registered office in another location, then the same can be incorporated on the invoice)

Invoice number – this has to be a sequentially numbered. Proper record has to be kept for any reversal and cancellation

Date of invoice

Name and address and GSTIN (if registered) of the customer / recipient of goods or service.

PAN of the customer – as per 2018 – 2019 budget speech, if invoice value is more than INR2.5L then capturing PAN of the buyer is mandatory.

HSN code – as described above

Quantity and Description of material being sold

Taxable Value (net of discount) – Actual price, discount value and the Net taxable amount can be mentioned, though showing discount is not mandatory (it is in the discretion of seller)

Category and Rate and GST, Amount of GST

Final invoice value

knowing basics of GST in India is very important for every traders or business persons.

E-Waybill

Supply of goods also involves e-waybill. A Seller / Consignor or Consignee or a transport partner of the goods can generate the e-way bill. The e-waybill is the evidence foe movement of goods. It needs to be generated with GST Login in the specific portal https://ewaybill.nic.in/ . if the transport partner is not registered under GST, then they can enroll on the common portal and generate the e-way bill for movement.

Non-GST Items Goods and Service

Which is excluded from GST?

Presently the following are exclusions of goods or service or activity from GST [popularly known as non GST items or “GST exemption list for services”]

Handled by Central Taxation

Basic Customs Duty

Excise Duty on Tobacco products

Export Duty

Taxes on petroleum products

Stamp Duties

Few specific Central Cess

Handled by State Taxation

Taxes on Liquors

Toll Tax/ Road Tax

Environment Tax

Property Tax

Purchase tax on food grains

Taxes on motor spirit & high speed diesel

The above is as given in the GST Portal https://www.gstindia.com/basic-concepts-of-gst-part-1/

Which is excluded from GST?

Presently the following are exclusions of goods or service or activity from GST [popularly known as non GST items or “GST exemption list for services”]

Handled by Central Taxation

Basic Customs Duty

Excise Duty on Tobacco products

Export Duty

Taxes on petroleum products

Stamp Duties

Few specific Central Cess

Handled by State Taxation

Taxes on Liquors

Toll Tax/ Road Tax

Environment Tax

Property Tax

Purchase tax on food grains

Taxes on motor spirit & high speed diesel

The above is as given in the GST Portal https://www.gstindia.com/basic-concepts-of-gst-part-1/

GST basic knowledge, GST basic information, GST basic concepts, Basic knowledge of GST, Basic concept of GST GST Rates

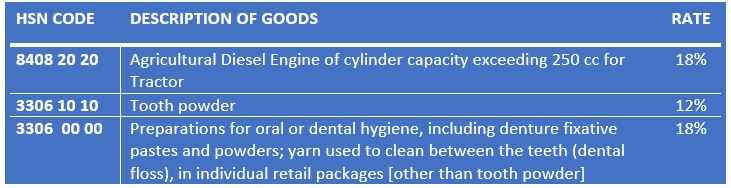

How are GST rates are identified and defined:

for identifying tax rate of goods India has adopted HSN and

for identifying tax rate of services SAC is used

Which slab of GST fits to your product?

One has to have HSN code for the product to charge correct GST. A set of example is given here.

SAC

SAC codes (Services Accounting Code) are issued by CBEC (Central Board of Excise & Customs) to uniformly classify each services under GST

knowing basics of GST in India is very important for every traders or business persons.

Download HSN code list

To identify GST slab for your product, HSN Code list is required made ready with respect to the description of product for which transaction has to be done or invoice / bill has to be raised. List of HSN Code is available in many government websites e.g. http://www.wbcomtax.nic.in/GST/GST_FAQ/GST_HSN_CODES.pdf gives the list in PDF.

There are a lot of queries float around for impact of taxation on freelancers, especially who provide their services to interstate or outside the country. Also, people doing online business have their tax (direct or indirect) queries always.

We have compiled answers in our pages here https://digitalregion.in/gst-for-freelancers/

Please check.

How can I apply for a GST number if I want to run ads for my own account in order to learn to run ads? Is it mandatory to have GST registration for ecommerce business?What is the rate of tax and HSN code in GST? How many country has GST?Do I need to register for a GST number?How can I sell my Namkeen product online, but the condition is that I don’t have a GST number?What are the important steps for setting up a new business in India?Can I use the same GST number for HSN and SAC code?Is it fair to call GST as Gabbar Singh Tax?What is the GST, and why? How?Can I get back 18% GST levied by Facebook ads through GST? If yes, what is the process?What is invoice and invoice discounting?How can local taxes impact small businesses? Can I work as a freelancer in India without GST while working a full-time job?For Facebook ads, is it required to pay GST?Is a proforma invoice a valid tax invoice?Is GST information required to open a PayPal account as a freelancer?How is GST contributing to our economy?How do I get a temporary GST number?

Bot Traffic