What defines a Recession in the economy?

A recession in the economy is resultant of many aspects. Which has numerous effects on over-all functioning of the economy and day-to-day life of common man. It modifies running of almost every business, effects employment ruins stock market and calls for immediate policy measures by the administration.

Technically, when two consecutive quarters post negative growth, it indicates a recession in the economy.

In simple words, recession comes when businesses see downtrend and the downtrend appears when spending comes down. It starts with less growth and starts declining towards negative.

Popular causes of a recession

- Reduced spending power

- High inflation rate

- High lending interest rate

- Lesser consumer confidence

The change in spending pattern is influenced by various factors depending on the industry you are in. It can be caused by the public spend, investment by foreign players or it can get triggered by government spend even. The emergency situations like, natural calamity, war, an act of terror, a huge fraud resulting loss to public etc are also activates such cycle. e.g. an unfortunate event of massive earthquake triggers downtrend to many businesses but it also activates spent from various agencies for recovering and hence demand of many object/service goes up after a shorter period.

Influence of Recession

The very first indication of a recession in the economy is that when the opportunity of doing business comes down. A feeling called recession runs down through the psychology of organizations to the human beings associated. Popularly it is known that during a recession, a vicious circle of no demand no investment operates. Organizations’ start becoming unreceptive to new projects, ongoing hiring process to start with, they take a stronger decision to the partial shutdown, manpower cut when the recession deepens. This affects the life of the employees and other business associates. In turn, employees tighten their personal spending and halt planned purchase. In the worst case, the terminated employees may start defaulting loans repayments. The entire process paints a gloomy picture of the entire economy.

The above process initiates lowering demand of all consumables and sometimes lowers the inflation to the extent of deflation. In the initial days, deflation looks good, but slowly with slowing demand and fall of price, companies are forced to reduce / cut production. This leads to severe unemployment throughout the chain or network.

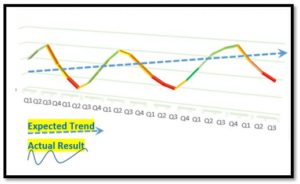

Risk and reward of a business is like two sides of a coin for any business activity. It is mainly dependent on many factors which can be tuned or handled by the business house / owner. But there are factors in every business which is not controllable by a single entity. Every business has its own cyclical nature. Besides your own effort to grow business, it is the overall business cycle which goes through ups and down depending upon various uncontrollable factors. The trend of the cycle (maybe upward or downward) is mostly triggered by demand-supply situation. When a financial crisis is driven by a monetary condition or an economic bubble it slips into recession. The swing of the trend can also depend on the macro-economic policies by the regulator or the government.

The relation between Gross Domestic Product (GDP) and Recession

As stated above, technically an economic recession occurs because of as a decline in the gross domestic product (GDP) for two or more quarters consecutively. Basically, the Gross Domestic Product (GDP) is the measure of the value of economic activity within a country. It is the market value of all goods and services produced in the country within a given timeframe. It normally does not take resale of goods into account e.g. sale of used automobiles. Again, in other words, Recession is lowered demand because of a lowered confidence level of the common man as a whole. This can be wither because of loss of jobs or fear of not performing well in the capacity of a business person.

“>A

Measures to be taken for recession

Being prepared:

Make sure that you always have sufficient fund to survive a normal lifestyle for 6 months at least. Specific saving plan to deal with recession (any point of time) should be in everybody’s portfolio.

Making timely payment of insurance premiums. Life, medical auto insurances are almost compulsory in today’s life. One has to make sure that they pay and plan payment all premiums properly.

Living with a budget. Every person who is financially organized has a budget to control / regulate their spend behaviour. It does not necessarily mean cutting down spend but to know what and where you spend so that analysis can be done whenever required.

Pay your debts in time without fail.

Long term investing in the stock market.

Importantly, keep yourself informed. Read, watch and browse the important updates to keep up with the current affair.

Expected steps from the government

To check recession in the economy, Governemnt should draw and rollout infrastructure development plan. This step quickly inducts the flow of money in the system, increases employment and pushes overall business mood upward. Hence spending grows over the period.

Cut tax. Often govt takes this step as a measure to give sop to the citizen.

Encourage export. To keep foreign currency reserve in good shape.

Reduce the lending rate. This measure encourages new investment either for new business or increase in spending power.

Encourage import of items prices of which are likely to up because of unethical business e.g. black-marketers.

Importantly, keep yourself informed. Read, watch and browse the important updates to keep up with the current affair. Recessions will come and go. One needs to be equipped better to fight the next downtrend which can peep again after a upcycle.

Keep reading the below suggests. These are the world’s best reads:

Recession at Work: HRM in the Irish Crisis (Routledge Advances in Management and Business Studies)

Accelerating out of the Great Recession: How to Win in a Slow-Growth Economy

156 Questions about How to Prevent Recession: Using Ancient Wisdom & Management Ideas

From Crisis to Recovery: The Causes, Course and Consequences of the Great Recession

A Good read. Thanks.

Your website attracts my attention to visit every day, thank you for all the information on this website is very useful

pretty! This has been a really wonderful post. Thanks for providing these details.

I always used to study article in news papers but now as I am a user of

net so from now I am using net for content, thanks to

web.

I like the efforts you have put in this, regards for all the great articles.

I have been checking out some of your stories and i can state pretty clever stuff. I will surely bookmark your website.

Hello. remarkable job. I did not anticipate this. This is a remarkable story. Thanks!

I simply wished to say thanks once again. I do not know the things that I would’ve handled without the entire tactics discussed by you concerning that subject. Certainly was a real fearsome situation in my opinion, but viewing a new professional fashion you solved that took me to weep with contentment. I am thankful for this guidance and even pray you know what a great job you have been getting into teaching the mediocre ones through the use of a web site. I am certain you’ve never encountered all of us.

I precisely wanted to thank you very much once more. I am not sure what I could possibly have achieved without the basics revealed by you directly on my subject. It was a real terrifying condition for me, however , spending time with a new well-written avenue you managed that took me to weep over delight. Now i am happy for your help and thus have high hopes you find out what an amazing job that you’re providing training other individuals with the aid of your webpage. More than likely you haven’t come across all of us.

It¦s actually a great and useful piece of info. I am glad that you simply shared this helpful info with us. Please stay us informed like this. Thanks for sharing.

I’m extremely impressed with your writing skills and also with the structure in your weblog. Is this a paid subject or did you customize it yourself? Either way keep up the excellent quality writing, it’s uncommon to see a nice weblog like this one these days..

No this was not a paid subject, have written just to answer queries from many.

Thanks for liking.

wonderful submit, very informative. I’m wondering why the other experts of this sector do not realize this. You should proceed your writing. I am sure, you’ve a huge readers’ base already!

I?¦ll right away grab your rss feed as I can not find your email subscription hyperlink or newsletter service. Do you’ve any? Kindly allow me know in order that I could subscribe. Thanks.

Nice post. I learn something more challenging on different blogs everyday. It will always be stimulating to read content from other writers and practice a little something from their store. I’d prefer to use some with the content on my blog whether you don’t mind. Natually I’ll give you a link on your web blog. Thanks for sharing.

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several e-mails with the same comment. Is there any way you can remove people from that service? Thanks!

Pretty nice post. I just stumbled upon your weblog and wanted to say that I have really enjoyed browsing your blog posts. In any case I’ll be subscribing to your rss feed and I hope you write again soon!

Great post. I was checking constantly this blog and I am impressed! Very helpful info particularly the last part 🙂 I care for such info much. I was looking for this particular info for a long time. Thank you and good luck.

Wonderful web site. Lots of useful info here. I?¦m sending it to several buddies ans also sharing in delicious. And obviously, thanks in your sweat!

I relish, lead to I discovered exactly what I was having a look for. You have ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

I am constantly browsing online for articles that can benefit me. Thank you!

Hi, I think your site might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, fantastic blog!

Thanks for informing. Would look into on priority.

and sorry for late reply.

I am pleased that I found this website, just the right information that I was looking for! .

Hello There. I discovered your weblog using msn. This is a really smartly written article. I will make sure to bookmark it and return to learn extra of your helpful information. Thank you for the post. I’ll definitely return.

Hi there very nice web site!! Man .. Beautiful .. Amazing .. I will bookmark your website and take the feeds alsoKI am glad to find so many helpful information here in the post, we need work out more techniques on this regard, thank you for sharing. . . . . .

As soon as I observed this site I went on reddit to share some of the love with them.

Great post. I am facing a couple of these problems.

I’ve been surfing on-line greater than 3 hours nowadays, but I never discovered any interesting article like yours. It is beautiful worth enough for me. In my opinion, if all website owners and bloggers made good content material as you did, the net will be a lot more helpful than ever before.

My developer is trying to convince me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using WordPress on a variety of websites for about a year and am concerned about switching to another platform. I have heard fantastic things about blogengine.net. Is there a way I can transfer all my wordpress content into it? Any help would be greatly appreciated!

Hey there! This post couldn’t be written any

better! Reading through this post reminds

me of my good old room mate! He always kept talking about this.

I will forward this page to him. Fairly certain he will have a good

read. Many thanks for sharing!

Wonderful beat ! I would like to apprentice while you amend your site, how can i subscribe for a

blog site? The account aided me a acceptable deal. I had been a little bit acquainted of

this your broadcast provided bright clear idea