Personal Credit Rating

What Is Credit Rating || How to get my credit rating in India ||How do I improve my credit rating? || What are the Important Points to Follow for Good Personal Credit Rating || How To Avoid Taking a Loan || What is Financial Fitness

What Is Credit Rating

A credit rating is a numerical evaluation of an individual’s or a company’s creditworthiness. It is an assessment of the likelihood that a borrower will repay their debts on time and in full. Credit ratings are typically assigned by credit rating agencies, such as Standard & Poor’s, Moody’s, and Fitch Ratings, and are based on factors such as the borrower’s credit history, financial stability, and debt-to-income ratio.

Credit ratings are used by lenders, investors, and financial institutions to determine the level of risk associated with lending money to a particular borrower. Higher credit ratings indicate a lower risk of default, and thus, a better credit history and a higher probability of being approved for loans, credit cards, or other financial products. On the other hand, lower credit ratings indicate a higher risk of default, and can result in higher interest rates, lower loan amounts, or denial of credit

How to get my credit rating in India

In India, you can get your credit rating from the credit information companies (CICs) registered with the Reserve Bank of India (RBI). The most well-known CICs in India are CIBIL (Credit Information Bureau (India) Limited), Experian, Equifax, and CRIF High Mark. To get your credit rating, you can follow these steps:

How to get my credit rating in India

In India, you can get your credit rating from the credit information companies (CICs) registered with the Reserve Bank of India (RBI). The most well-known CICs in India are CIBIL (Credit Information Bureau (India) Limited), Experian, Equifax, and CRIF High Mark. To get your credit rating, you can follow these steps:

Visit the website of the CIC you want to use.

Request for your credit report: You can request for a one-time report or enroll in a credit monitoring service.

Provide required personal and financial information: You will be required to provide basic personal information, such as your name, date of birth, and PAN number, as well as financial information, such as your loan and credit card details.

Pay the fee: Most CICs charge a fee for providing a credit report.

Wait for the report: The report will be delivered to you either online or through the mail.

Review the report: Review the report carefully to make sure the information is accurate and up-to-date.

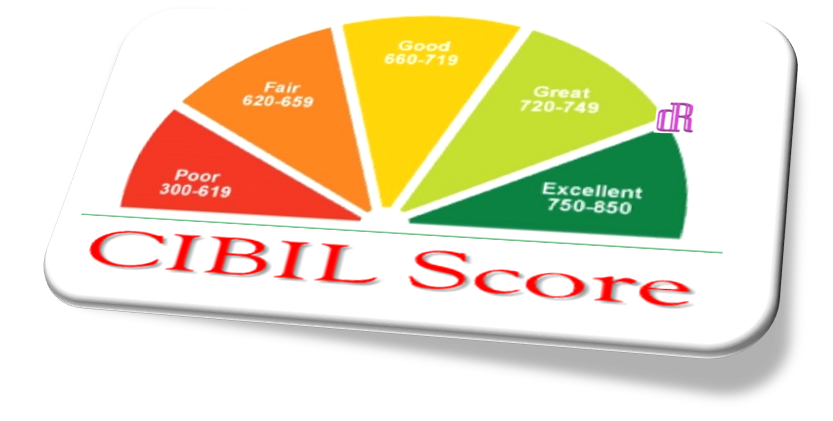

Your credit report will contain information about your credit history, including your loan and credit card payments, bankruptcies, and other credit-related activities. The report will also include your credit score, which is a three-digit number that ranges from 300 to 900. The higher the score, the better your credit rating.

How do I improve my credit rating?

Improving your credit rating can take time, but it’s possible with the following steps:

Pay bills on time: Late payments can have a significant impact on your credit rating, so it’s important to pay all your bills on time.

Keep balances low on credit cards: High balances relative to credit limits can hurt your credit rating, so try to keep your balances low and pay them off in full each month.

Limit new credit applications: Every time you apply for credit, it creates a new hard inquiry on your credit report, which can lower your credit rating. So, limit the number of new credit applications.

Dispute errors on your credit report: If you find errors on your credit report, dispute them with the credit bureau and have them corrected.

Consider credit counseling: If you’re struggling with debt or managing your finances, consider reaching out to a credit counseling agency for guidance.

Be patient: Improving your credit rating takes time, so be patient and keep working on paying your bills on time and keeping your balances low.

Remember, maintaining a good credit rating is important for accessing credit at favorable terms and achieving financial goals. A little effort to manage your credit well can pay off in the long run.

How To Avoid Taking A Loan

There are several ways to avoid taking a loan:

Create a budget and stick to it. This will help you control your spending and prioritize your expenses.

Save for emergencies. Having a savings account will reduce the need to take out a loan in case of unexpected expenses.

Live below your means. Avoid lifestyle inflation and try to keep your expenses low.

Invest in income-generating assets. Consider investing in stocks, real estate or starting a side business to increase your income.

Reduce debt. Pay off existing debts before taking on new ones.

Seek financial advice. Talk to a financial advisor or attend a personal finance course to better understand how to manage your money.

Be patient. Avoid making impulsive purchases and wait until you have saved enough to pay for them in cash.